Will any solar power stock ever be a money maker? That's what investors in First Solar (FSLR) have been wondering for some time. The only thing that was able to boost First Solar's share value was the Obama administration's threat to slap a tariff on Chinese solar panels. That action, which also helped Canadian Solar (CSIQ), was prompted by allegations that the Chinese government is subsidizing solar panel makers.

Yet as you can see, the official help may not be enough to sustain First Solar's share price, which has been seesawing up and down. Part of the reason for the slide is concerns about the quality of the company's solar panels and rumors that some of them might be a fire hazard. Such rumors caused First Solar, Trina Solar (TSL), Suntech Power Holdings (STP), and JA Solar Holdings (JASO) share prices to fall last week.

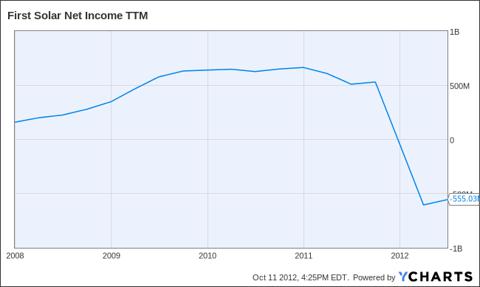

Okay, so much for the news, good and bad; value investors have to focus on a company's numbers, not on the headline. So do First Solar's numbers make it a value investment? At first glance, the answer is no. First Solar reported some terrible numbers on June 30, including a net income of -$555.03 million. That's pretty awful, especially when you consider that First Solar's Market cap is $1.886 billion and its enterprise value is $1.714 billion. The money the company lost in the last year was nearly one third of its value.

If that wasn't bad enough, First Solar's earnings yield was -29.54%, which made for a diluted earnings per share figure of -$6.42. These numbers also gave First Solar a net profit margin of -17.79% and a P/E of -$3.40. Basically, anybody that put money in First Solar lost it. The company hasn't figured out how to turn solar electric into profits yet. Its year to date performance has been -35.63%.

This situation is made worse by the fact that First Solar has liabilities of $2.126 billion and cash from operations of $625.71 million. Those figures are not good because First Solar actually lost more cash from investing than it brought in through operations. First Solar lost $668.78 million in cash from investments in the past year.

The numbers at First Solar are not entirely bad; the company registered a sales growth of 7.9% this year. That isn't enough to make up for the lousy income figures or the investment losses, but it is a step in the right direction.

Like other solar companies, First Solar has excellent prospects overseas, particularly in developing countries like India. The Indian government has plans to install 20 gigawatts of solar electric generation by 2022. First Solar has already won contracts for building panels for two of those operations.

The problem is that growth is in the future, not now. It is possible that First Solar will be profitable someday, but it isn't now. The best course of action for a value investor is to stay away from First Solar and other solar companies until they actually start making some money. None of these companies has figured out to make money on solar panels, although First Solar has demonstrated an impressive capability for supplying large scale solar electric projects.

The reason why this sector is so bad is obvious. The charts for competitors such as Canadian Solar Inc. show much the same story as those for First Solar do. As you can see, Canadian Solar has been declining even faster and farther than First Solar has.

Canadian Solar's stats seem to be just as those at First Solar. When it last issued a financial statement on March 31st, Canadian Solar reported that its year-to-year revenue growth fell by 26.52% between March 2011 and March 2012. Canadian Solar's net income was -$118.02 million for its last fiscal year. The scary thing is that First Solar and Canadian Solar seem to be the leaders in this business.

The bottom line is that solar panel makers are not yet a value investment. At least one of these companies needs to demonstrate that it can actually make some money. So far, none of them seem to have done that. The best strategy on First Solar is to watch and wait; it might be a value investment someday, but not now.

Source: http://seekingalpha.com/article/923901-solar-sector-avoid-this-value-trap

Yet as you can see, the official help may not be enough to sustain First Solar's share price, which has been seesawing up and down. Part of the reason for the slide is concerns about the quality of the company's solar panels and rumors that some of them might be a fire hazard. Such rumors caused First Solar, Trina Solar (TSL), Suntech Power Holdings (STP), and JA Solar Holdings (JASO) share prices to fall last week.

Okay, so much for the news, good and bad; value investors have to focus on a company's numbers, not on the headline. So do First Solar's numbers make it a value investment? At first glance, the answer is no. First Solar reported some terrible numbers on June 30, including a net income of -$555.03 million. That's pretty awful, especially when you consider that First Solar's Market cap is $1.886 billion and its enterprise value is $1.714 billion. The money the company lost in the last year was nearly one third of its value.

If that wasn't bad enough, First Solar's earnings yield was -29.54%, which made for a diluted earnings per share figure of -$6.42. These numbers also gave First Solar a net profit margin of -17.79% and a P/E of -$3.40. Basically, anybody that put money in First Solar lost it. The company hasn't figured out how to turn solar electric into profits yet. Its year to date performance has been -35.63%.

This situation is made worse by the fact that First Solar has liabilities of $2.126 billion and cash from operations of $625.71 million. Those figures are not good because First Solar actually lost more cash from investing than it brought in through operations. First Solar lost $668.78 million in cash from investments in the past year.

The numbers at First Solar are not entirely bad; the company registered a sales growth of 7.9% this year. That isn't enough to make up for the lousy income figures or the investment losses, but it is a step in the right direction.

Like other solar companies, First Solar has excellent prospects overseas, particularly in developing countries like India. The Indian government has plans to install 20 gigawatts of solar electric generation by 2022. First Solar has already won contracts for building panels for two of those operations.

The problem is that growth is in the future, not now. It is possible that First Solar will be profitable someday, but it isn't now. The best course of action for a value investor is to stay away from First Solar and other solar companies until they actually start making some money. None of these companies has figured out to make money on solar panels, although First Solar has demonstrated an impressive capability for supplying large scale solar electric projects.

The reason why this sector is so bad is obvious. The charts for competitors such as Canadian Solar Inc. show much the same story as those for First Solar do. As you can see, Canadian Solar has been declining even faster and farther than First Solar has.

Canadian Solar's stats seem to be just as those at First Solar. When it last issued a financial statement on March 31st, Canadian Solar reported that its year-to-year revenue growth fell by 26.52% between March 2011 and March 2012. Canadian Solar's net income was -$118.02 million for its last fiscal year. The scary thing is that First Solar and Canadian Solar seem to be the leaders in this business.

The bottom line is that solar panel makers are not yet a value investment. At least one of these companies needs to demonstrate that it can actually make some money. So far, none of them seem to have done that. The best strategy on First Solar is to watch and wait; it might be a value investment someday, but not now.

Source: http://seekingalpha.com/article/923901-solar-sector-avoid-this-value-trap

No comments:

Post a Comment