A huge bumper crop of solar panels already has caused a sharp decline in their prices and bankrupted many manufacturers worldwide over the past two years. Now a research report released Tuesday says another 180 solar panel makers will likely go out of business or be bought by 2015.

Nearly half of them – or 88 companies – will shut down factories in countries that have become too expensive for producing solar panels, namely the United States, Europe and Canada, said GTM Research. The report looks at over 300 solar panel makers to determine their chances of survival.

The prognosis is not only shocking, but it also answers a perennial question, at least for now, about whether solar manufacturing can thrive in the United States. China, which has used state owned banks and utilities to finance solar factory expansion and create domestic demand for solar panels, will continue to dominate solar manufacturing, though the government is reportedly working on rescuing only 12 large companies and forcing mergers in others. GTM is estimating that 54 solar panel makers in China will not survive over the next three years.

“Given where the industry is right now and how committed China is for its solar manufacturing industry, it’s very difficult for the U.S. to compete,” said Shyam Mehta, the senior analyst who authored the GTM report. In fact, by the end of 2013, cell and panel manufacturing could disappear all together in the United States.

China’s rise as the world’s epicenter for solar manufacturing has elicited resentment from rivals who believe Chinese companies haven’t competed fairly. The U.S. Department of Commerce recently sided with petitioners of such a trade complaint and imposed tariffs after finding that Chinese solar companies have indeed received illegal government subsidies and sold solar panels at below cost.

Signs of trouble began to show in early 2011, when changes in solar incentive policies in key European markets prompted solar panel makers’ customers – distributors and project developers – to delay purchasing decisions. Prices for solar panels began to fall faster than what manufacturers had expected. The prices dropped by about 50 percent last year and have continued to decline this year. At the same time, many manufacturers had built up massive factories and were counting on a huge surge in demand in the global market. In fact, they continued to churn out solar panels to keep their factories running and workers employed even though demand wasn’t keep pace.

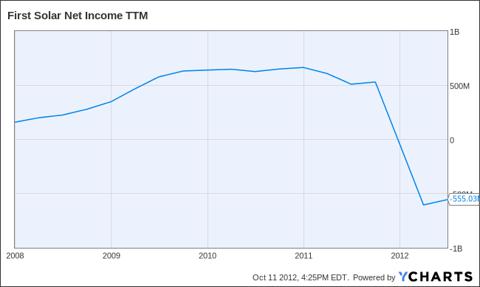

First Solar, an industry bellwether, saw flat revenues and lower earnings during the first quarter of 2011. Life pretty much went downhill from there for many solar panel makers and their suppliers. Young companies that were entering mass production of their technologies in order to compete effectively with larger rivals went bust, including Solyndra and Abound Solar. GE, which once embarked on an ambitious plan to build a 400-megawatt factory in Colorado, decided to shelve that project earlier this year. First Solar, long the king of low-cost manufacturing, decided to gradually shut down its big factory in Germany and put on hold its plans to build new factories in Vietnam and Arizona. Other solar panel makers in the U.S., Europe and Asia have made similar decisions to shutter factories or file bankruptcy.

SunPower is one of them. The San Jose company announced Tuesday it will suspend production at six of the 12 solar cell production lines and cut solar panel production by 20% in the Philippines. It plans to lay off about 900 employees, most of them located in the Philippines.

Still, some solar manufacturers have proceeded with their plans to build new factories for a variety of reasons. Some thought the oversupply problem would be over soon; others needed to scale up their production to cut costs. As a result, the world will likely see 35 gigawatts of excess solar panels for sale per year over the three years, GTM said.

The plummeting prices for solar panels are good news for installers and solar power plant developers – and ultimately consumers. Some developers have switched to solar panels instead using other types of solar technologies. An increasing number of manufacturers have entered the business of developing solar energy generation projects since they are not making money selling solar panels.

Source: http://www.forbes.com/sites/uciliawang/2012/10/16/report-180-solar-panel-makers-will-disappear-by-2015/

Nearly half of them – or 88 companies – will shut down factories in countries that have become too expensive for producing solar panels, namely the United States, Europe and Canada, said GTM Research. The report looks at over 300 solar panel makers to determine their chances of survival.

The prognosis is not only shocking, but it also answers a perennial question, at least for now, about whether solar manufacturing can thrive in the United States. China, which has used state owned banks and utilities to finance solar factory expansion and create domestic demand for solar panels, will continue to dominate solar manufacturing, though the government is reportedly working on rescuing only 12 large companies and forcing mergers in others. GTM is estimating that 54 solar panel makers in China will not survive over the next three years.

“Given where the industry is right now and how committed China is for its solar manufacturing industry, it’s very difficult for the U.S. to compete,” said Shyam Mehta, the senior analyst who authored the GTM report. In fact, by the end of 2013, cell and panel manufacturing could disappear all together in the United States.

China’s rise as the world’s epicenter for solar manufacturing has elicited resentment from rivals who believe Chinese companies haven’t competed fairly. The U.S. Department of Commerce recently sided with petitioners of such a trade complaint and imposed tariffs after finding that Chinese solar companies have indeed received illegal government subsidies and sold solar panels at below cost.

Signs of trouble began to show in early 2011, when changes in solar incentive policies in key European markets prompted solar panel makers’ customers – distributors and project developers – to delay purchasing decisions. Prices for solar panels began to fall faster than what manufacturers had expected. The prices dropped by about 50 percent last year and have continued to decline this year. At the same time, many manufacturers had built up massive factories and were counting on a huge surge in demand in the global market. In fact, they continued to churn out solar panels to keep their factories running and workers employed even though demand wasn’t keep pace.

First Solar, an industry bellwether, saw flat revenues and lower earnings during the first quarter of 2011. Life pretty much went downhill from there for many solar panel makers and their suppliers. Young companies that were entering mass production of their technologies in order to compete effectively with larger rivals went bust, including Solyndra and Abound Solar. GE, which once embarked on an ambitious plan to build a 400-megawatt factory in Colorado, decided to shelve that project earlier this year. First Solar, long the king of low-cost manufacturing, decided to gradually shut down its big factory in Germany and put on hold its plans to build new factories in Vietnam and Arizona. Other solar panel makers in the U.S., Europe and Asia have made similar decisions to shutter factories or file bankruptcy.

SunPower is one of them. The San Jose company announced Tuesday it will suspend production at six of the 12 solar cell production lines and cut solar panel production by 20% in the Philippines. It plans to lay off about 900 employees, most of them located in the Philippines.

Still, some solar manufacturers have proceeded with their plans to build new factories for a variety of reasons. Some thought the oversupply problem would be over soon; others needed to scale up their production to cut costs. As a result, the world will likely see 35 gigawatts of excess solar panels for sale per year over the three years, GTM said.

The plummeting prices for solar panels are good news for installers and solar power plant developers – and ultimately consumers. Some developers have switched to solar panels instead using other types of solar technologies. An increasing number of manufacturers have entered the business of developing solar energy generation projects since they are not making money selling solar panels.

Source: http://www.forbes.com/sites/uciliawang/2012/10/16/report-180-solar-panel-makers-will-disappear-by-2015/