Will solar stocks end up as penny stocks? Well, that's quite possible. Here is Seeking Alpha contributor Tom Winnifrith:

He goes on to provide a rationale for shorting two particular solar stocks, LDK Solar (LDK) and JA Solar (JASO). And indeed, he might very well be right and make some money from these short positions:

The SA bio of Winnifrith doesn't suggest that he's a climate scientist, but these days it seems that anybody can espouse scientific opinions. We're not joining in (we're no climate scientists either) but we just sum up a few things that are not in doubt:

We do feel that any non-scientist should have very solid reasons for not taking the conclusions of the overwhelming majority of climate scientists serious. Here is Leo Hickman:

We'll leave it up to the scientists to debate these issues and the best way to deal with them. However, to suggest that solar energy is a fake solution to an imaginary problem misses the point. Yes the industry is struggling, but this is due to its success, not its failure.

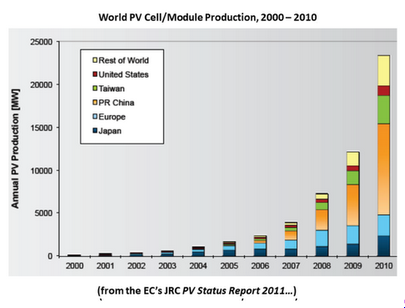

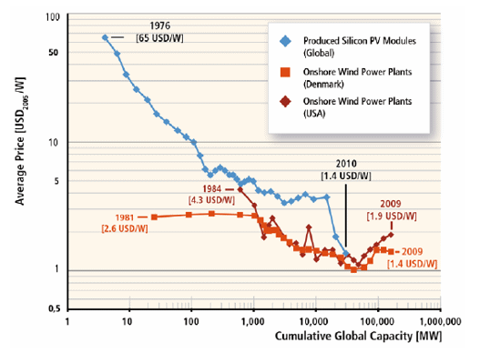

The reason for what Winnifrith argues is a "collapse of the industry" is that the prices of solar panels have collapsed (see blue line in the figure below).

Panel prices were $25/watt in the 1980s, and $5/watt as little as 5 years ago. They are now way below $1/watt, a price with which most solar panel makers struggle. Indeed, so rapidly has the price eroded recently that even a one year old figure like the one above is already outdated.

But make no mistake, while this situation might endure for a while yet, it is not going to last. The collapse in prices (a veritable Moore's Law in energy) has also boosted demand and reduced the need for subsidies.

Many solar companies struggle with high debt (a result of previous expansion), inventory write-offs and overcapacity. These problems aren't likely to disappear overnight but this doesn't render the whole industry nonviable. Some of the problems can be solved by forestalling investments.

Some companies will go out of business (many already have), or will be taken over. Some of the problems will gradually lessen when supply and demand rebalance and prices stabilize. However dark things look now, that might be sooner than you think, for two reasons.

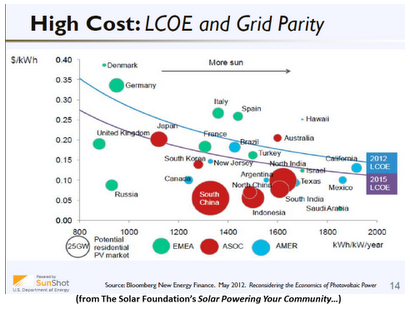

First, with panel prices continuing to fall, the geographic area where solar energy can compete with electricity from the grid is increasing. Areas with high electricity tariffs and lots of sunshine, like Hawaii, already have achieved grid parity. Here is Cris Meehan:

Well, Chu is a politician. Here is an entrepreneur, founder of Suntech (STP) Dr. Shi:

And here is Wolfgang Schlichting:

Even in the US grid parity is already achieved in some locations:

Betting against China?

Betting against Chinese solar stocks, especially this late in the game, isn't without risk either:

But the biggest reason to be optimistic in the longer-run is that China itself has woken up to the increasing price competitiveness of solar energy, and the need for some kind of orderly restructuring of the industry. They are also looking for ways to revive economic growth, which is faltering. And they can build only so many new airports, high-speed train tracks, apartments and shopping malls, the stuff of the previous stimulus.

Which is why they are now quadrupling the domestic installation target from 5 to 21GW by 2015. And even this might be conservative:

While China is likely to be the biggest market over the next few years by far, one should not close one's eyes to the growth in demand elsewhere. Japan is also ramping up after the Fukushima disaster, so is the Middle-East, India and Latin America. Solar installations doubled in the US in 2011 and growth is likely to continue there as well.

Which leads us to Winnifrith's short thesis on JASO and LDK (others will follow, he argued). He could be successful, but it's pretty late in the game for shorting already. Whether China will let big solar companies like JASO and LDK go bankrupt remains to be seen (plenty of smaller Chinese solar companies already have).

So shorting these companies isn't exactly risk-free. Surprises are possible. Look what happened to another Chinese solar company, Jinko Solar (JKS). On Monday Augustus the 27th, it announced it had won a contract in a bidding from China Guangdong Nuclear to supply 30MW of solar modules to a PV power plant in Hami city in China. Its share price shot up by tens of percentage points in the subsequent days and are now 60% off their recent lows.

With China bent on seriously ramping up solar panel use, these kinds of events are going to be more common. Whether any possible returns from shorting Chinese solar companies weighs against these risks remains very much to be seen...

Source: http://seekingalpha.com/article/846681-solar-stocks-ending-as-penny-stocks

Amid the blind rush to combat global warming, solar energy was seen as a slam dunk growth industry. Investors rushed to risk speculative capital. Governments rushed to spunk taxpayers' cash up against the wall. And now it is all ending in tears.

He goes on to provide a rationale for shorting two particular solar stocks, LDK Solar (LDK) and JA Solar (JASO). And indeed, he might very well be right and make some money from these short positions:

I offer up LDK Solar at $1.38 and JA Solar at $0.96. In both cases, my target price is more or less nothing. I am sure that there are other shorts out there in this sector, and I will move on to others at a later point.Before we get to the merits of shorting solar stocks, there is something else as Winnifrith then goes on making a curious statement:

I personally do not believe that there is a shred of evidence for man-made climate change. But the political elites embraced the idea with an almost religious fervor. That is to say they could not accept that there was any doubt about the idea, even though there is actually no evidence for it at all.

The SA bio of Winnifrith doesn't suggest that he's a climate scientist, but these days it seems that anybody can espouse scientific opinions. We're not joining in (we're no climate scientists either) but we just sum up a few things that are not in doubt:

- There is no doubt that CO2 is a greenhouse gas

- There is no doubt that man made activities have significantly increased the levels of CO2 in the atmosphere

- Since there are other factors impacting global temperatures and measuring the latter consistently is a bit of a challenge, there is some wiggle room. However, the overwhelming majority of those that can be called specialist in the field (that is, actual climate scientists) think there is a relation between rising CO2 and increasing temperatures.

We do feel that any non-scientist should have very solid reasons for not taking the conclusions of the overwhelming majority of climate scientists serious. Here is Leo Hickman:

In much of our lives, we rely on the testimony and views of experts. We do so when we feel ill and choose to visit the doctor. We do so when we want to reduce our tax liabilities. We do so when we wish to be ably represented in a court of law. We do so when a strange noise appears from the engine of our car.

We'll leave it up to the scientists to debate these issues and the best way to deal with them. However, to suggest that solar energy is a fake solution to an imaginary problem misses the point. Yes the industry is struggling, but this is due to its success, not its failure.

The reason for what Winnifrith argues is a "collapse of the industry" is that the prices of solar panels have collapsed (see blue line in the figure below).

Panel prices were $25/watt in the 1980s, and $5/watt as little as 5 years ago. They are now way below $1/watt, a price with which most solar panel makers struggle. Indeed, so rapidly has the price eroded recently that even a one year old figure like the one above is already outdated.

But make no mistake, while this situation might endure for a while yet, it is not going to last. The collapse in prices (a veritable Moore's Law in energy) has also boosted demand and reduced the need for subsidies.

Many solar companies struggle with high debt (a result of previous expansion), inventory write-offs and overcapacity. These problems aren't likely to disappear overnight but this doesn't render the whole industry nonviable. Some of the problems can be solved by forestalling investments.

Some companies will go out of business (many already have), or will be taken over. Some of the problems will gradually lessen when supply and demand rebalance and prices stabilize. However dark things look now, that might be sooner than you think, for two reasons.

First, with panel prices continuing to fall, the geographic area where solar energy can compete with electricity from the grid is increasing. Areas with high electricity tariffs and lots of sunshine, like Hawaii, already have achieved grid parity. Here is Cris Meehan:

As recently as June, during the World Renewable Energy Forum, U.S. Department of Energy Secretary Steven Chu said that Brazil would join a growing number of countries where solar is at parity with grid-supplied electricity. He noted that prices for grid-supplied electricity in both Italy and Spain are at parity with solar now. "Australia has now dipped below that and can now dip into this mode of: 'Oh! That's cheaper. By 2013 Brazil will slip in and California is on the cusp. This is residential," he said.

Well, Chu is a politician. Here is an entrepreneur, founder of Suntech (STP) Dr. Shi:

When I started Suntech in 2001, the average levelized cost of energy for a solar project in good sunlight was around $0.50 per kilowatt-hour, or higher. Today, new solar power plants are promising clean electricity for less than $0.10 per kilowatt-hour -- that's without subsidies.... This is no fringe industry, as Suntech alone has produced enough solar panels to power Costa Rica or Paraguay. Even the concept of grid parity no longer makes much sense, because in many countries we're right in the thick of it.

And here is Wolfgang Schlichting:

[W]e are already at - or have passed through - grid parity at several locations in the world…[including Hawaii, tropical island nations in the Caribbean and South Pacific, and parts of Spain]…In 2013, we expect parts of Italy, Brazil, Chile and Australia to also reach the threshold. Thereafter, the Philippines, California, Japan and others will follow…[from] 2014 to 2016…

Even in the US grid parity is already achieved in some locations:

The recent Renewable Auction Market (RAM) saw 20 year power purchase contracts awarded in California at $0.089/kWh, a clear sign that this overall fall in system costs has now lead to projects bidding under the average residential energy price in the United States [renewableenergyworld]

Betting against China?

Betting against Chinese solar stocks, especially this late in the game, isn't without risk either:

Obtaining a clear picture of the Chinese companies' debts can be difficult, analysts said, because debts they often listed as short-term liabilities are perpetually rolled forward, essentially making them long-term facilities. Nearly every solar company has been losing cash because of low panel prices, and policy makers in Beijing said last year that they wanted to see a healthier industry develop, with a smaller number of large, strong players. Whether that consolidation will be spurred by Beijing or the debt-holding banks remains unclear. [New York Times]

But the biggest reason to be optimistic in the longer-run is that China itself has woken up to the increasing price competitiveness of solar energy, and the need for some kind of orderly restructuring of the industry. They are also looking for ways to revive economic growth, which is faltering. And they can build only so many new airports, high-speed train tracks, apartments and shopping malls, the stuff of the previous stimulus.

Which is why they are now quadrupling the domestic installation target from 5 to 21GW by 2015. And even this might be conservative:

"With a significant tumble in photovoltaic prices, the timetable for mass use is ahead of time," said Lian Rui, a senior analyst for the research company Solarbuzz. "The new target is still very conservative; we expect the installation to surpass 30 gigawatts." [Bloomberg]Even if just the 20GW installation target is met in 2015, that means that China will install in one year what the entire world installed in 2011. And it does make sense. By greatly ramping up solar panel installations, China would achieve multiple goals at once:

- Ease the burden of their domestic solar companies

- Allow even bigger economies of scale and learning in their domestic solar companies, solidifying their competitive advantage

- Ease their dependence on fossil fuels

- Ease the terrible pollution problem in their cities

- Stimulate the economy.

While China is likely to be the biggest market over the next few years by far, one should not close one's eyes to the growth in demand elsewhere. Japan is also ramping up after the Fukushima disaster, so is the Middle-East, India and Latin America. Solar installations doubled in the US in 2011 and growth is likely to continue there as well.

Which leads us to Winnifrith's short thesis on JASO and LDK (others will follow, he argued). He could be successful, but it's pretty late in the game for shorting already. Whether China will let big solar companies like JASO and LDK go bankrupt remains to be seen (plenty of smaller Chinese solar companies already have).

So shorting these companies isn't exactly risk-free. Surprises are possible. Look what happened to another Chinese solar company, Jinko Solar (JKS). On Monday Augustus the 27th, it announced it had won a contract in a bidding from China Guangdong Nuclear to supply 30MW of solar modules to a PV power plant in Hami city in China. Its share price shot up by tens of percentage points in the subsequent days and are now 60% off their recent lows.

With China bent on seriously ramping up solar panel use, these kinds of events are going to be more common. Whether any possible returns from shorting Chinese solar companies weighs against these risks remains very much to be seen...

Source: http://seekingalpha.com/article/846681-solar-stocks-ending-as-penny-stocks

No comments:

Post a Comment