GTM Research identifies the factors that are shaping the residential solar market this year.

This week GTM Research delivered the Q2 Market Briefing to solar subscribers. In it, Cory Honeyman, U.S. Solar analyst at GTM Research, identified four trends to watch in the residential solar market in the second half of this year.

Consolidated distribution of demand

Pulling data from the U.S. Solar Market Insight report, Honeyman shows that California's market share of solar installations has grown from 43 percent in Q1 2010 to 56 percent in the first quarter of this year. Between 2011 and 2013, the same four states have consistently topped the charts every year: California, Hawaii, Arizona, and New Jersey. Perhaps more surprising is the fact that the top ten states accounted for more than 90 percent of residential installations in 2013.

"Residential installers have been doubling down within a select number of state markets to achieve scale," said Honeyman. "As national residential installation figures reveal, geographic consolidation has proven to be quite successful in spurring consistent growth for leading installers. However, this strategy makes the market's future stability disproportionately exposed to regulatory risk across a small number of states."

Growing retail rate parity

As install prices fall, state incentives become less vital to the success of the residential solar market. In the first three months of this year, 58 percent of residential photovoltaic (PV) installations in IOU territories in California were installed without incentives, compared to 17 percent the year prior.

According to Honeyman, "Retail rate parity is arguably less a driver of growth, and more so an indication of other strategies and forces increasing the attractiveness of residential solar across leading state markets. With average national residential system prices 28 percent less than what they were three years prior, we're seeing a growing number of projects pencil out without state incentives."

GTM Research has previously noted that this trend was unfolding in California, but it's now happening in Arizona and other, smaller markets such as Nevada.

Alongside meaningful reductions in hardware costs, the 28 percent dropoff in system prices is linked to installers' innovative customer acquisition strategies and benefits from falling financing costs.

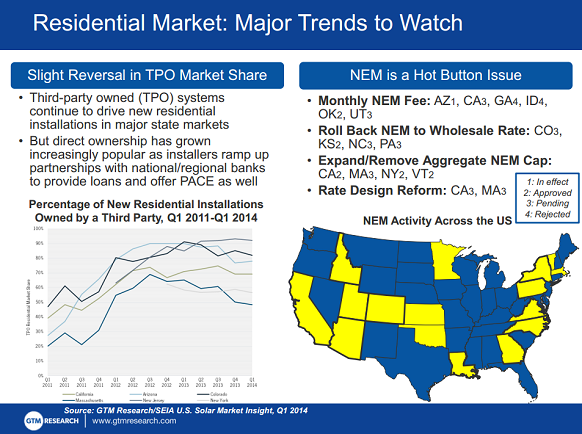

Slight reversal in third-party ownership market share

As reported last week, GTM Research is forecasting third-party ownership of residential solar to peak in 2014. "Direct ownership has grown increasingly popular as installers ramp up partnerships with national and regional banks to provide loans and offer PACE," wrote Honeyman.

“Solar loans are becoming widely available with many more options to choose from than in the past, and declining system costs are making direct ownership affordable for more homeowners,” said Nicole Litvak, GTM Research Analyst. “As a result, the share of third-party-owned solar has already begun to come down in leading state markets, including Arizona and Massachusetts.”

Net metering is a hot issue

GTM Research is keeping a close eye on the net metering landscape across the United States. At present, four states have a monthly fee approved, pending or in effect, while Georgia, Louisiana and Idaho have rejected a fee-based model.

"Residential solar may account for less than 1 percent of peak demand in the U.S., but states with varying levels of customer penetration levels -- from more than 234,00 homeowners in California to slightly fewer than 500 homeowners in Minnesota -- are already grappling with reforms to valuing power generated by residential rooftop PV systems," wrote Honeyman.

"No precedent has been set as to what we can expect from utilities, with reforms including value-of-solar tariffs (VOST), increases to aggregate NEM capacity limits, rolling back NEM from the retail price to a lower wholesale avoided cost rate, and monthly NEM fees."

The extent to which new fees or revisions to net metering design change the value of solar PV is a hot topic on everyone's radar within the residential space. With the introduction of a monthly net metering fee for residential customers in APS territory back in January of this year, Arizona is the first state where installers already have to bake in net metering reforms to lease terms or system prices pitched to homeowners.

According to GTM Research, the U.S. residential PV market will exceed 1 gigawatt for the first time in 2014.

Source: http://www.greentechmedia.com/articles/read/four-residential-solar-trends-to-watch?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+GTM_Solar+%28GTM+Solar%29

No comments:

Post a Comment