These forecasts are included in Bloomberg New Energy Finance’s Market 2030 outlook, which includes detailed forecasts for Australia and Asia, both of which have major implications for the coal industry – exporters and local generators.

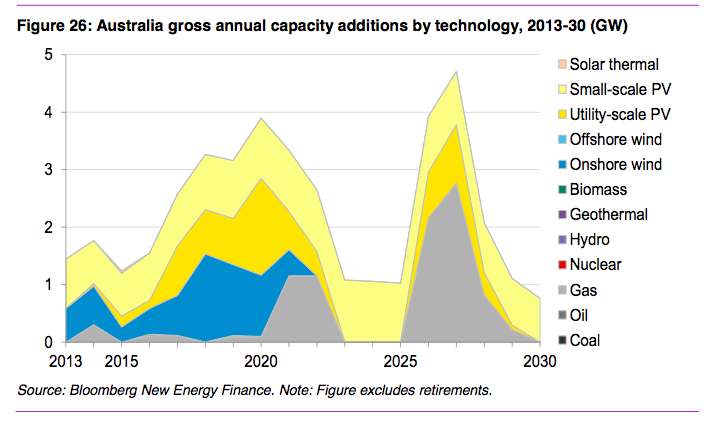

The most striking prediction is that for solar PV, which BNEF says will dominate capacity and investment over the next decade and a half. It expects 15.8GW of rooftop solar to be built in Australia out to 2030 – mostly on the basis of fundamental economics.

It suggests the payback for rooftop solar will halve to just three years by 2030. That is based on no subsidies and no carbon price, but it argues that it is still a compelling proposition to households.

“Australia, like Japan, has high retail electricity prices which, combined with continuously reducing technology costs, are the main reasons for the small-scale PV adoption rate,” it writes.

“The favourable economics of the small-scale PV technology – ie, the reduction in payback period – will drive the sixfold increase in small-scale PV capacity and the technology’s contribution to total capacity additions between 2013 and 2030.”

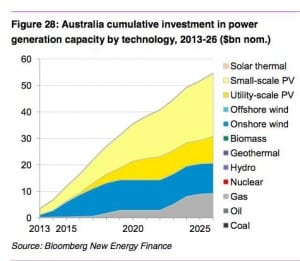

BNEF expects households and businesses will invest another $24 billion on rooftop solar (a similar prediction was made by ),

While the speed and breadth of the rooftop solar deployment will be influenced slightly by policy changes, the deployment of large-scale renewables is almost entirely dependent on the state of policies such as the renewable energy target.

Assuming that it stays in place, BNEF believes that nearly 8GW of utility-scale PV will be built out to 2030. Two thirds will be driven by the LRET – presuming it stays in place – and a further 2.7GW to cater for increases in peak demand, particularly in Western Australia and the Northern Territory.

It also predicts that 6.4GW of wind capacity is built to meet the LRET. Extraordinarily, this build out occurs until 2020, but then no wind energy is built at all after that because the only new capacity installed will be designed to meet summer peaks – hence the focus on utility scale solar. BNEF’s analysis suggests little solar thermal will be built.

Coal is not built at all, but gas enjoys a boom in the middle of next decade to also cope with summer peak demand, and to replace 6.2GW of retired capacity.

BNEF says coal’s total share of Australian generation capacity is projected to fall from 45 per cent in 2013 to 27 per cent in 2030. Gas also falls from 30 per cent to 23 per cent. In contrast, renewable capacity increases from 24 per cent to 48 per cent, with wind rising from 5 per cent to 10 per cent and solar from 5 per cent to 29 per cent of total capacity.

Fossil fuel generation falls from 85 per cent to 64 per cent, but most of this is at the expense of gas, because of the removal of the carbon price and high gas prices.

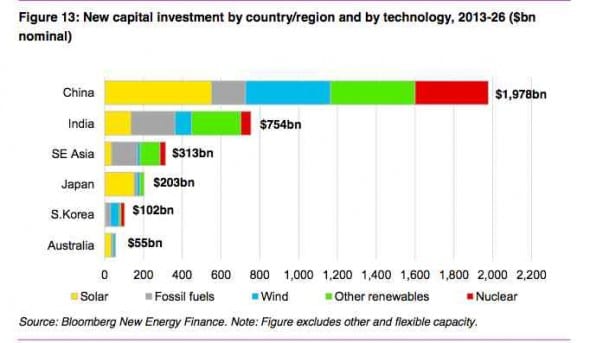

But the solar boom will not be limited to Australia. BNEF expects solar to form a significant part of the power generation build in the major economies of Asia, to the exclusion of coal-fired generation in particular – a bad sign for Australia’s aspiring coal exporters.

Of this, nearly $1 trillion will be in the form of solar, $0.62 trillion for hydro and $0.55 trillion for wind.

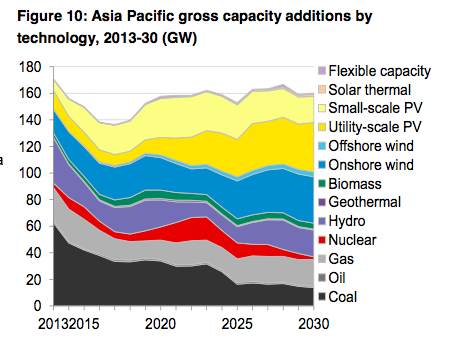

And this graph below illustrates what it means in terms of capacity additions. Coal declines rapidly, nuclear has the bumpiest ride, and eventually falls as India will allocate no more financing to the technology from 2023 due to policy uncertainty and fuel restrictions.

China will invest $38 billion a year on solar (utility and small-scale) and $28 billion a year on onshore and offshore wind, Japan will throw $11 billion a year on solar (mostly small-scale), India $10 billion (mostly utility-scale, off-grid or micro-grid), while Indonesia and the Philippines will each invest $3 billion a year in geothermal.

Source: http://reneweconomy.com.au/2014/australias-solar-boom-has-only-just-begun-bloomberg-58987

No comments:

Post a Comment