Regulations move markets

The U.S. Energy Information Administration (EIA) recently reported:

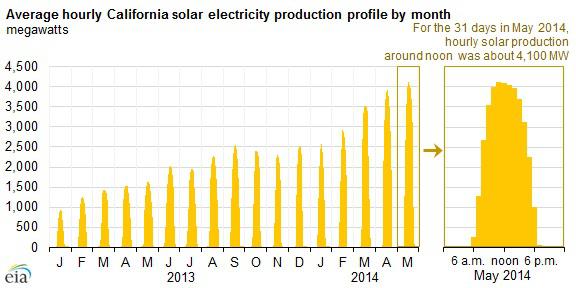

The California Independent System Operator (CAISO) recorded a record midday hourly peak of 4,767 megawatts of alternating current (MWAC) of utility-generated solar electricity delivered into the California grid.

|

| Source: CAISO Daily Renewables Watch |

|

| Source: CAISO Daily Renewables Watch |

In addition, the Massachusetts Department of Public Utilities has issued new orders to modernize their electric grid:

With these orders, Massachusetts is the first state in the nation to require electric distribution companies to take steps to modernize the electric grid, according to state officials.Each of these announcements is just the latest buzz in a flurry of activity that is taking place in the power generation and distribution markets. Like it or not, regulation and market incentives are altering the power map.

Grid storage is key

A key element in all of this is the implementation of large capacity utility grid storage systems—or big batteries. One example, pumped hydro storage, has been in place for decades and is a proven performer but requires large initial investments, unique sites and years of approvals, permits and construction. Furthermore, smart grid technologies indicate a favor for high capacity, embedded, small footprint storage devices. These can implement a number of technologies, but are basically large, quick response batteries distributed throughout the grid, allowing the system to rapidly adapt to changing generation and consumption levels.

While there are many privately held start-ups in the market, each vying for their piece of the economic pie, if the past is any indication most of these will eventually fail or be bought out by the big players. These include such giants as General Electric , which has already been active in the arena with its past acquisition of Beta R&D and its cooperative agreements with Arista Power and Xtreme Power. GE's Energy Storage division currently offers megawatt scalable storage that integrates with existing grid management systems. GE's Schenectady, New York plant gives it the U.S. based manufacturing facilities to meet demand.

Another big player is NRG Energy ; the large, New Jersey-based, energy provider has already announced a redirected focus from conventional energy production to both grid and home-based renewables. NRG is supporting private firms such as grid storage battery innovator EOS Genesis and Stirling engine backup power developer Deka Research, whose engine is designed to provide localized power from abundant and clean natural gas.

Regardless of the market drivers, grid power storage is critical to the future of both unpredictable renewables and the smart grid build out. The small innovators are driving the technologies, but the big players are already sponsoring them and will likely absorb them in the future, integrating their innovations into their bottom line.

Do you know this energy tax "loophole"?

You already know record oil and natural gas production is changing the lives of millions of Americans. But what you probably haven't heard is that the IRS is encouraging investors to support our growing energy renaissance, offering you a tax loophole to invest in some of America's greatest energy companies. Take advantage of this profitable opportunity by grabbing your brand-new special report, "The IRS Is Daring You to Make This Investment Now!," and you'll learn about the simple strategy to take advantage of a little-known IRS rule. Don't miss out on advice that could help you cut taxes for decades to come.

Source: http://www.dailyfinance.com/2014/06/30/solar-and-the-smart-grid-success-depend-on-grid-st/

No comments:

Post a Comment